Understanding Key Real Estate Investment Terms

Real estate investments can be an excellent way to build wealth, but the language of real estate investing often feels like alphabet soup—cap rate, IRR, equity multiples, cash yield. For new and even experienced investors, these terms can be confusing. Having a firm grasp of the fundamentals will help you evaluate opportunities more clearly and make informed decisions.

Below, we’ll break down some of the most important real estate investment terms you’re likely to encounter.

Cap Rate (Capitalization Rate)

The cap rate measures the expected annual return from a property, assuming it was purchased in cash (without debt).

- Formula: Net Operating Income (NOI) ÷ Purchase Price

- Example: If a property generates $100,000 in NOI and is purchased for $1,250,000, the cap rate is 8%.

- Use: A quick way to compare properties or assess if the income stream justifies the price.

IRR (Internal Rate of Return)

The IRR represents the annualized return an investor expects to earn over the life of an investment, taking into account both cash flow and eventual sale proceeds.

- Why It Matters: Unlike the cap rate, IRR considers the time value of money—a dollar today is worth more than a dollar tomorrow.

- Use: Helpful when comparing investment opportunities with different hold periods and cash flow patterns.

Net Return

This is the profit remaining after all expenses, fees, and taxes have been deducted.

- Why It Matters: Gross returns can be misleading if fees and costs aren’t factored in. Net return shows what actually ends up in your pocket.

Cash Yield (Cash-on-Cash Return)

Cash yield measures the annual cash income relative to the cash you invested upfront.

- Formula: Annual Pre-Tax Cash Flow ÷ Initial Cash Invested

- Example: If you invest $200,000 and receive $20,000 in annual cash distributions, your cash yield is 10%.

- Use: Ideal for income-focused investors seeking to understand the annual cash flow generated by their investment.

Equity Multiple

The equity multiple tells you how much total cash you’ve received compared to what you invested.

- Formula: Total Cash Distributions ÷ Total Equity Invested

- Example: A $100,000 investment that returns $200,000 over its life has a 2.0x equity multiple.

- Use: A simple measure of total return—did you double your money or fall short?

Other Key Terms to Know

- NOI (Net Operating Income): Income after operating expenses, but before financing costs.

- Debt Service Coverage Ratio (DSCR): NOI ÷ Debt Payments; measures a property’s ability to cover its loan obligations.

- LTV (Loan-to-Value): Loan Amount ÷ Property Value; a lender’s measure of risk.

- Exit Strategy: How and when the investor or fund plans to sell or refinance the property.

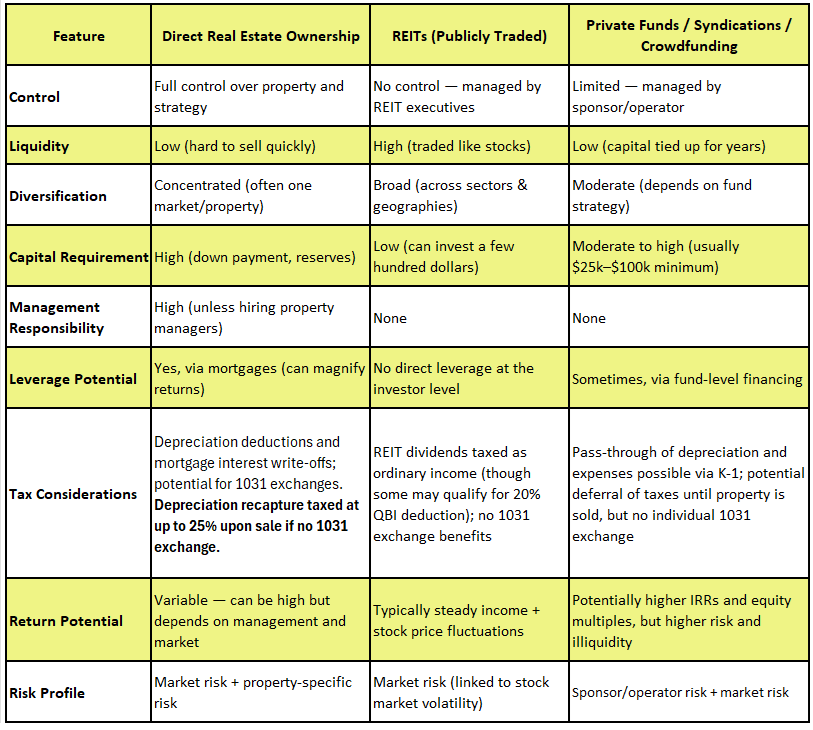

Real Estate Ownership Options

When considering real estate, you’re not limited to buying physical properties. You can also invest through Real Estate Investment Trusts (REITs) or other pooled investment vehicles.

Key Takeaways on Taxes

- Direct Ownership: The most flexible for tax planning, especially with depreciation and 1031 exchanges to defer capital gains.

- REITs: Dividends are generally taxed at ordinary income rates, though the 20% QBI deduction (for qualified REIT dividends) can soften the blow. There are no depreciation deductions for individual investors.

- Private Funds/Syndications: Investors may receive pass-through tax benefits such as depreciation and expense deductions (reported on a K-1), which can shelter some income. However, you typically can’t control when gains are realized.

Bringing It All Together

Each path into real estate has unique strengths. If you want hands-on control and direct tax advantages, owning property may be right for you. If you value liquidity and diversification, REITs offer stock-like convenience. Private funds and syndications offer access to institutional-level deals but require patience and trust.

The most successful investors look beyond just the numbers. They evaluate their goals, time horizon, and tolerance for hands-on management before deciding whether to buy a property outright, invest in a REIT, or explore other vehicles.

Real estate investing can be complex, but with the proper knowledge, you’ll have the tools to evaluate opportunities like a pro. If you need assistance navigating these topics, connect with us today to discuss real estate investment strategies.

Please consult with your financial advisor and/or tax professional to determine the suitability of these strategies. All views, expressions, and opinions in this communication are subject to change. This communication is not an offer or solicitation to buy, hold, or sell any financial instrument or investment advisory services.