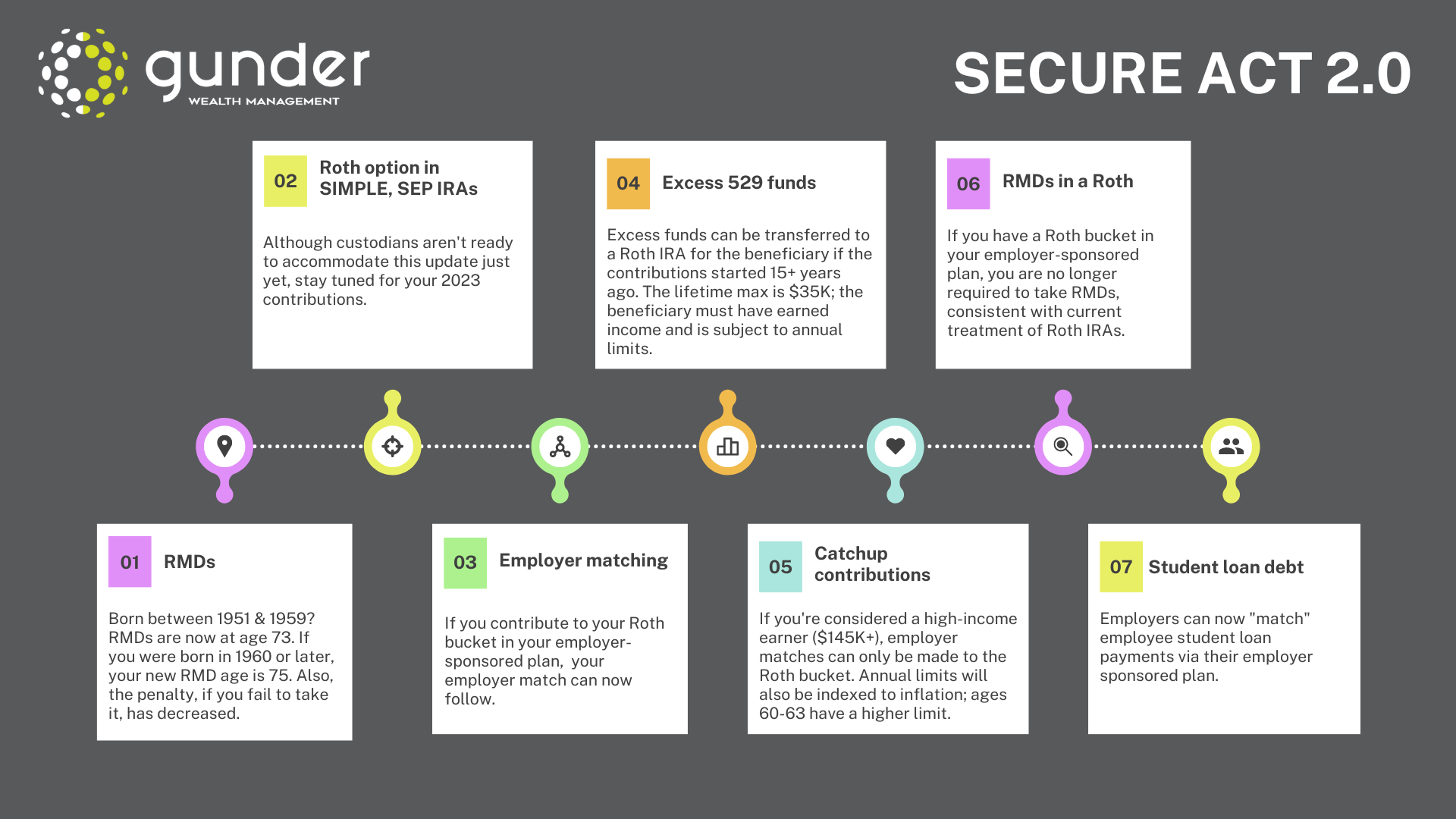

The Secure Act 2.0 passed on December 29, 2022, with over 100 changes to existing retirement rules!

While we aren’t sure who has the time to craft these nuanced rules, we identified seven key planning items effective over the next few years related to Secure Act 2.0.

Items on the Docket for this year (2023)

Required Minimum Distributions (RMD)

- If you were born between 1951 & 1959, RMDs begin at age 73.

- If you were born in 1960 or later, RMDs begin at age 75.

- The penalty for failing to take an RMD will decrease to 25% of the RMD amount (currently 50%) and 10% if corrected timely.

Roth options in SEP & SIMPLE IRAs

- This was long overdue!

Employer matching

- Retirement plan matches are now eligible in a Roth account.

- It may take time for plan providers to offer this and update payroll systems.

Items on the docket soon (2024/2025)

Extra funds in a 529 account?

- Consider transferring into a beneficiary’s Roth IRA; requirements include:

- The beneficiary must have earned income.

- Annual contribution limits apply (i.e., $6,500 currently).

- The lifetime contribution limit is $35,000.

- The account must be open for at least 15 years.

RMDs in a Roth

- If you have a Roth bucket in your employer-sponsored plan, you are no longer required to take RMDs.

- This is consistent with the current treatment of Roth IRAs.

Catch-up Contributions

- Employer-sponsored retirement plans

- Are your wages over $145,000? If so, you can only make catch-up contributions to a Roth account.

- In 2025 individuals ages 60 through 63 will be able to make catch-up contributions of up to $10,000 annually (indexed to inflation). The current catch-up contribution for those 50 years and older is $7,500.

- IRAs & Roth IRAs – the current $1,000 catch-up contribution is indexed to inflation in increments of $100.

Do You Have Student Loan Debt?

- If so, employers can “match” employee student loan payments via payments to a retirement account.

Let’s have a conversation to see how these changes may impact you; contact us today.

All views, expressions, and opinions included in this communication are subject to change. This communication is not intended as an offer or solicitation to buy, hold or sell any financial instrument or investment advisory services.