Have you asked (or wondered): When’s a good time to get into the market? The market seems hot; is it time to get out? What’s in store for 2024? Should we prepare for a recession this year?

We don’t time the markets, and we certainly don’t pretend to know what will happen. Even though we’re well-versed in the economy and market conditions, no one knows what will happen; 2023 was a perfect example of that! It’s our job to stay current and construct diversified, cost-conscious, and tax-efficient portfolios.

From negative to positive

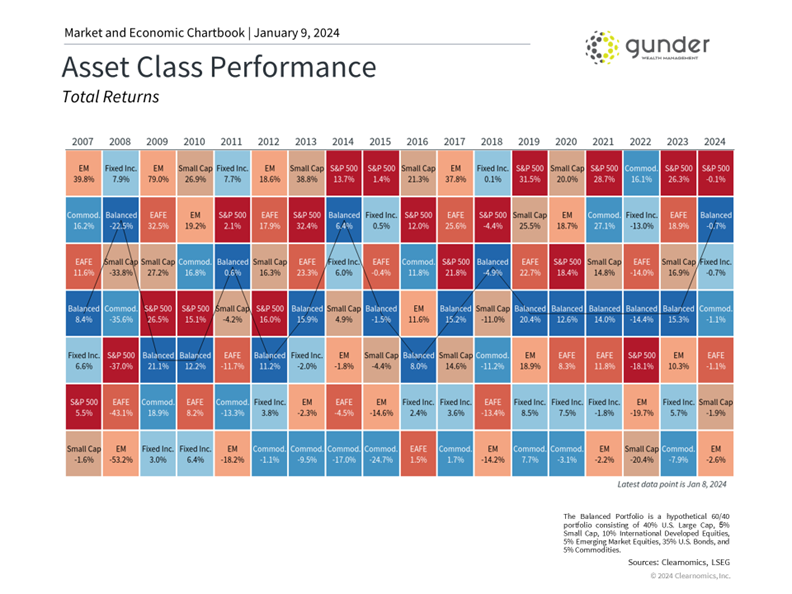

Before we address our outlook for 2024, let’s look back at the last couple of years. If you love getting into the details, review our commentary below. Alternatively, skip the read and check out the chart at the end, illustrating the disparity in asset class performance between 2022 and 2023. For example, a balanced portfolio returned a negative 14.4% in 2022, followed by a positive 15.3% in 2023!

Even though “staying the course” may not resonate with your urgency to DO SOMETHING, for the investors that did precisely that, the market rewarded them.

Let’s review 2023

2023 marked an inflection point for markets with solid gains across stocks and bonds. The S&P 500, Dow, and Nasdaq generated exceptional returns of 26.3%, 16.2%, and 44.7%, respectively, with reinvested dividends. The S&P has come full circle and is now only a fraction of a percentage point below the all-time high from exactly two years ago. The U.S. 10-year Treasury yield climbed as high as 5% in October before falling to end the year around 3.9%, pushing bond prices higher in the process. International stocks also performed well, with developed markets returning 18.9% and emerging markets 10.3%.

What drove these results? The most important lesson of 2023 for everyday investors is that news headlines and economic events don’t always impact markets in apparent ways. Last year’s positive returns occurred despite historic challenges, including:

- The worst banking crisis since 2008

- Unprecedented, rapid Fed rate hikes

- Debt ceilings and budget battles in Washington

- The ongoing war in Ukraine

- The conflict in the Middle East

- Cracks in China’s economy.

If you shared these headlines with an investor (or an expert!) at the start of 2023, they would have predicted a worsening bear market or a deep recession.

Why wasn’t 2023 doom and gloom?

At the risk of oversimplification, inflation was the critical factor driving markets over the past few years. Inflation affects all parts of the economy, including:

- Forcing the Fed to raise interest rates

- Slowing growth

- Hurting corporate profits

- Dampening consumer spending

- Acting as a drag on bond returns.

This is exactly what occurred in 2022, but many of these effects reversed in 2023 as inflation rates improved.

For instance, the headline Consumer Price Index jumped 9.1% in June 2022 on a year-over-year basis but only grew 3.1% this past November. Unfortunately for consumers and retirees, this does not mean prices will fall back to pre-pandemic levels; we anticipate they likely will rise more slowly. For markets, however, what matters is that the rate of change is slowing and that core inflation could gradually approach the Fed’s 2% long-run target.

The recession that many of us anticipated a year ago has yet to occur. While many still expect economic growth to slow this year, it’s not unreasonable to suggest that the Fed could achieve a “soft landing” in which inflation stabilizes without causing a recession. This is why both markets and Fed forecasts show that they could begin to cut policy rates by the middle of the year.

Strong economic growth and falling rates propelled many asset classes higher last year. The chart below illustrates the disparity in asset class returns, particularly when reviewing 2023 vs. 2022.

What’s in store for 2024?

If 2022 was characterized by the worst inflation shock in 40 years, leading to a decline in stocks and bonds, 2023 saw many of these factors turn around. These trends could continue if the Fed does begin to ease monetary policy. Of course, much is still uncertain, and investors should always expect the unexpected regarding market, economic, and geopolitical events. After all, markets never move in a straight line, and even the best years experience short-term pullbacks.

It’s worth mentioning that 2024 is an election year. We can look at past election years to forecast this year, but this year is markedly different:

- Uncertain rate environment

- Market capitalization concentration (Magnificient Seven)

- Recession risk

- Government shutdown deliberation

- Escalating geopolitical tensions

Macro factors aside, other factors include:

- Government scrutiny of AI

- SEC’s approval of Bitcoin ETFs

- Reinvigorated housing market

- Surging oil and natural gas prices

- Softening consumer spending

While we wish we had a magic ball, we don’t! But it’s important to be mindful of the variables at play. Stay tuned this year as we navigate the bullets mentioned. 2023 reminded us it’s important to stay invested and diversified across all market cycle phases rather than try to predict what might happen in the short term.

Connect with us to discuss your portfolio strategy in the year ahead!

Please consult with your financial advisor and/or tax professional to determine the suitability of these strategies. All views, expressions, and opinions in this communication are subject to change. This communication is not an offer or solicitation to buy, hold or sell any financial instrument or investment advisory services.